Rachel Reeves has said she does not want to repeat the £40 billion tax rises she implemented in her first Budget “ever again”.

The fiscal announcement was a chance to “wipe the slate clean” following the Conservatives’ time in power, the Chancellor told broadcasters as she defended the Budget on Thursday morning.

Choices made by Ms Reeves will see the overall tax burden reach a record 38.3% of gross domestic product (GDP) in 2027-28, the highest since 1948.

Despite Labour’s promises to protect “working people”, a £25.7 billion increase in national insurance contributions paid by employers is likely to reduce wages and lead to job losses, something Ms Reeves herself admitted.

Asked about the consequences of the move, the Chancellor told BBC Breakfast: “I said that it will have consequences.

“It will mean that businesses will have to absorb some of this through profits and it is likely to mean that wage increases might be slightly less than they otherwise would have been.”

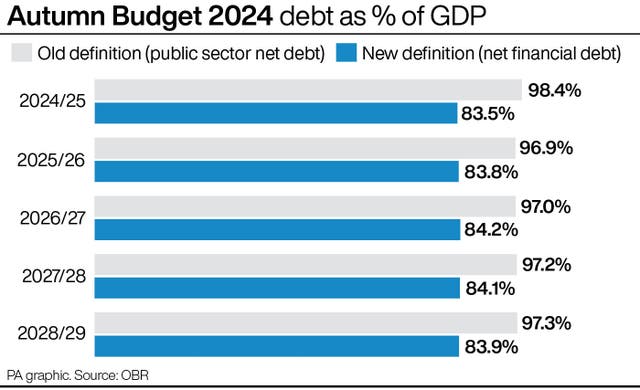

Ms Reeves plans to pour more public cash into schools, hospitals, transport and housing – and will change the way government debt is measured to allow her greater borrowing flexibility.

Fiscal watchdog the Office for Budget Responsibility (OBR) has however predicted the measures will be unlikely to lead to the longer term boost in economic growth the Government wants to see.

And influential economics think tank the Institute for Fiscal Studies (IFS) has said she may need to raise taxes again in future if her “gambles” on spending do not result in growth.

“This Budget was to wipe the slate clean after the mismanagement and the cover-up of the previous government,” Ms Reeves told Times Radio.

She added: “I had to make big choices. I don’t want to repeat a Budget like this ever again, but it was necessary to get our public finances and our public services on a stable trajectory.”

The Chancellor was also unable to say whether her pledge at the Budget to raise income tax thresholds after 2028 was guaranteed.

“I’m not going to be able to write future budgets,” she said.

Shadow chancellor Jeremy Hunt meanwhile said his counterpart had angered many people, who felt she had not lived up to the spirit of Labour’s manifesto promises not to increase taxes for working people.

“Many people thought this was a new Labour prospectus, not a traditional tax-and-spend prospectus, and they have woken up to a Chancellor who has given us the biggest tax-raising Budget in history,” Mr Hunt told BBC Breakfast.

The Government’s spending measures are expected to provide a temporary boost to GDP, according to the OBR’s forecast.

But the watchdog predicted downgrades in subsequent years, and said the Budget measures will add to pressure on inflation and interest rates.

IFS director Paul Johnson warned Ms Reeves may have to come back for “another round of tax rises in a couple of years’ time – unless she gets lucky on growth”.

Meanwhile, the International Monetary Fund (IMF) endorsed the investment and spending on public services in the Chancellor’s Budget, as well as sustainable tax rises.

In an unusual move, the Washington-based watchdog said: “We support the envisaged reduction in the deficit over the medium term, including by sustainably raising revenue.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel